Firm News

Firm News

Premises Liability: Protecting Your Business Against Claims

Opening a business means taking on risks. For businesses that maintain storefronts, office spaces, or other premises that are open to the public for the purpose of conducting business, some of these risks include premises liability lawsuits. Premises liability insurance can help to protect a company from potentially devastating losses in the event that a visitor files a claim, but a number of other steps can also help to prevent premises liability lawsuits and lay the groundwork for a strong defense in the event that a premises liability claim is filed. Finding out the options for protecting the business ahead of time can make premises liability claims easier to navigate if and when issues do arise. To seek tailored advice regarding the most appropriate measures for your business to take to prevent and address premises liability claims, consider reaching out to the business law attorneys with Schwab & Gasparini. Contact one of our New York offices by calling: Syracuse Office (315) 422-1333; Albany Office (518) 591-4664; White Plains Office (914) 304-4353; or Hudson Valley (914) 304-4353 to set up a consultation.

Types of Business Liability Insurance

When a business opens in New York, it must comply with a wide range of regulations, according to the New York Small Business Development Center (NYSBDC). There is no escaping the fact that we live in a litigious society. A single lawsuit can tie up a business' operations, deplete capital, and, in extreme cases, force a business to close. These are all good reasons to have a robust premises liability insurance policy.

Some general liability insurance policies incorporate premises liability coverage. The optimum combination of insurance policies will depend on the type of business and its relative risk exposure, so an overview of some common types of business insurance may be helpful in establishing context for premises liability coverage.

Commercial General Liability (CGL) Insurance

A general liability policy can protect a business against the risk of financial losses due to being sued and held liable for malpractice, injury, or negligence when the suit filed pertains to the direct activities of the business. Examples can include the operations of a retail store or restaurant where an incident might occur. A liability claim can also be a "work-away" claim about items a company makes, sells, or distributes. Commercial general liability insurance policies may also cover the activities of workers who perform services away from business headquarters, such as the members of a plumbing crew. A good general liability policy has the potential to evolve to cover new exposures as they crop up.

Directors & Officers Liability

A director or officer of a company could be accused of wrongful acts by third parties such as shareholders or customers. With a directors and officers liability policy, those managers would be protected against those claims. That allows those officers to focus on running the company instead of worrying about protracted litigation.

Professional Liability Insurance

A business that provides professional services to others may need professional liability insurance or an “errors and omissions” (E&O) insurance policy. Among the types of companies that commonly carry this type of insurance policy are professional service firms, media organizations, consultants, and recruitment firms. This policy protects a business even against a lawsuit without merit.

Workers Compensation Insurance

Businesses must carry workers' compensation insurance. In New York, Chapter 67 of the Consolidated Laws of New York covers a wide range of possible scenarios related to workers’ compensation claims. Workers' compensation policies provide coverage to an employee who is injured or gets sick because of their job. The policies pay for medical care and lost wages. Additionally, workers compensation policies can protect a business from lawsuits due to work injuries or illnesses. Usually, if an employee receives benefits from a worker's compensation claim, they cannot seek additional financial remedies.

What Are Premises Liability Principles?

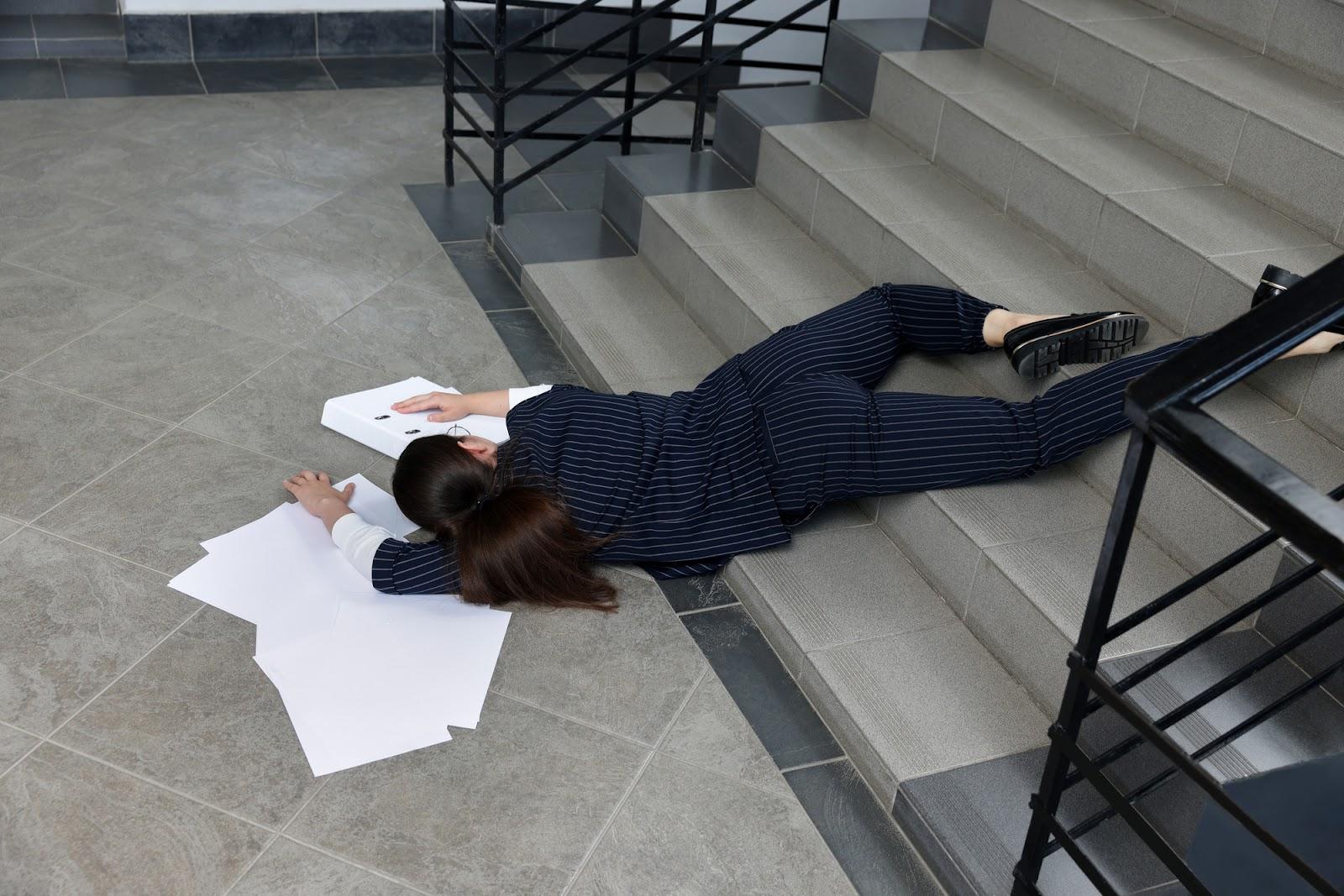

While all of the above liability risks and their protections are important, one of the areas of enterprise risk about which business law attorneys are asked most often is premises liability. Most business owners whose customers visit them at a physical location are aware of the possibility of lawsuits due to slip and fall accidents, negligent security incidents, and other potential premises liability claims –– but they may not be sure of how premises liability law works, or all of the steps they can take to protect themselves and their business.

Premises Liability: What Are Premises?

Simply put, a property owner is obligated to maintain a safe environment for anyone who enters their property. That legal responsibility is referred to as premises liability. Premises can refer to retail stores, restaurants, hotels, theaters, office buildings, and private residences; premises are the business location or private home at which an incident (or an alleged incident) takes place.

Premises Liability: What Is Liability?

The liability involved in a premises liability claim is the legal responsibility the property owner may have for the damages someone suffered while visiting those premises. A claim can be made against the property owner if a visitor to the premises is injured and the injured party alleges that their injuries are due to the property owner’s negligence.

What Happens in a Premises Liability Lawsuit?

Premises liability insurance claims may be filed if someone visiting a property is injured while on the premises. Many commercial insurance policies cover such claims; so do some types of homeowners’ insurance. A premises liability lawsuit may sometimes be filed when the property owner’s insurance refuses to cover the damages sought by the party seeking compensation. These lawsuits can be filed against private individuals, but they are also commonly filed against businesses, especially those that maintain premises open to the public. Regardless of who the defendant is in a premises liability lawsuit, the plaintiff will need to prove the following four essential elements in order to win their case:

Duty of Care

Duty of care refers to the property owner's responsibility to the person making the claim against them. In general, the “duty of care” is understood to be highest toward visitors to the premises who are implicitly or explicitly invited onto the property for the purpose of conducting business. Such “invitations” would extend to any staff member, a customer, or a vendor who delivers a product or provides a service at the premises.

Breach of Duty

When a plaintiff alleges that a property owner has breached their duty of care, they are saying that the property owner has failed to maintain a safe environment. A typical example would be a business that does not promptly clean up a liquid spill on the floor that then triggers a slip and fall accident.

Causation

In a premises liability lawsuit, it is not enough for the plaintiff to show that the property owner breached their duty of care; to succeed in their claim, they must also show that this breach of duty led to the incident and its subsequent injuries. The breach of duty described above must have caused the injury suffered by the person bringing the claim against the property owner.

Damages

The plaintiff must prove they have suffered damages because of the breach of duty, and attempt to define these damages. Common examples of damages for which compensation may be sought in a premises liability lawsuit include:

- Physical injuries

- Emotional distress

- Medical expenses

- Loss of income

To determine if a claim meets those four elements, consider discussing the matter with the experienced legal professionals at Schwab & Gasparini.

Why Is Premises Liability Important?

Premises liability is important because it constitutes a very common cause of lawsuits against businesses. Although premises liability claims are often covered under a company’s general liability insurance policy, it is important for business owners to be aware of the terms of the specific policy they carry, and any exclusions, restrictions, or eligibility requirements that may apply, such as predetermined limits on the amount covered per claim or the performance of regular property inspections to ensure sound maintenance procedures. Many organizations maintain premises liability insurance policies as vital components of their company’s comprehensive risk management strategy.

A crucial part of the daily operation of any business is to be proactive against accidents. However, there are scenarios when an unforeseen accident occurs. For instance, a customer can track in rain puddles to a grocery store. Before the workers can mop up the puddles, someone could slip and fall. With premises liability insurance in place, the business will have a "safety net" that covers the damages suffered by an injured customer in the event of such an accident. Premises liability coverage, although it does not prevent an accident, can mitigate the financial impact an injury claim may have on the company.

Deal With Premises Liability Claims

If a premises liability claim is filed against your business, even if you carry robust commercial general liability insurance, consider seeking out the counsel of an experienced law firm to provide support and guidance. Schedule an initial consultation with the team from Schwab & Gasparini by calling one of our offices, conveniently located throughout New York State: Syracuse (315 )422-1333, Albany (518) 591-4664, and White Plains Office or Hudson Valley (914) 304-4353 to set up a time for your conversation with our team.

Categories

Month Archives

Syracuse

109 South Warren Street

Suite 306

Syracuse, NY 13202

Phone: 315-422-1333

Fax: 315-671-5013

White Plains

222 Bloomingdale Road

Suite 200

White Plains, NY 10605

Phone: 914-304-4353

Fax: 914-304-4378

Hudson Valley

1441 Route 22

Suite 206

Brewster, NY 10509

Phone: 914-304-4353

Fax: 914-304-4378

© Copyright 2024 Schwab & Gasparini. All Rights Reserved. Sitemap | Legal | Law Firm Essentials by PaperStreet Web Design